Auto E-Invoice / E-Way Bill

⚡ One-Click e-Invoice & e-Way Bill – No More GSTIN Hassles!

Generate both e-Invoice and e-Way Bill with a single click in ERP Crystal Symphony. The system automatically:

- Connects to the GSTIN portal

- Fetches your IRN (Invoice Reference Number)

- Retrieves your EBN (E-Way Bill Number)

- Embeds QR codes into the invoice

- Makes it ready to print and dispatch

- ✅ No more logging in to the GSTIN portal manually.

- ✅ No JSON file uploads.

- ✅ No duplicate data entry.

Everything is done instantly and compliantly — saving you time, effort, and errors.

Before You Start - Quick Checklist

| Category | Requirement |

|---|---|

| System | Ensure the E-Invoice feature is enabled in ERP Crystal Symphony. If not already enabled, please contact your system administrator. |

| GST Details | GSTIN details and transporter information must be set for: • Your company (seller) • The customer (buyer). If not already done, update these details before proceeding. |

| Ship To Details | If a Ship To details is selected, ensure address, location, pincode, and state are filled. These details will be auto-fetched from the first item line of the order. |

| UOM | Make sure the Unit of Measure (UOM) is selected for the first line item. |

| Freight | If sales order needs freight, add freight item to invoice |

| Attempts | Avoid multiple failed attempts |

| Cancelled | Cancelled invoices can’t be processed |

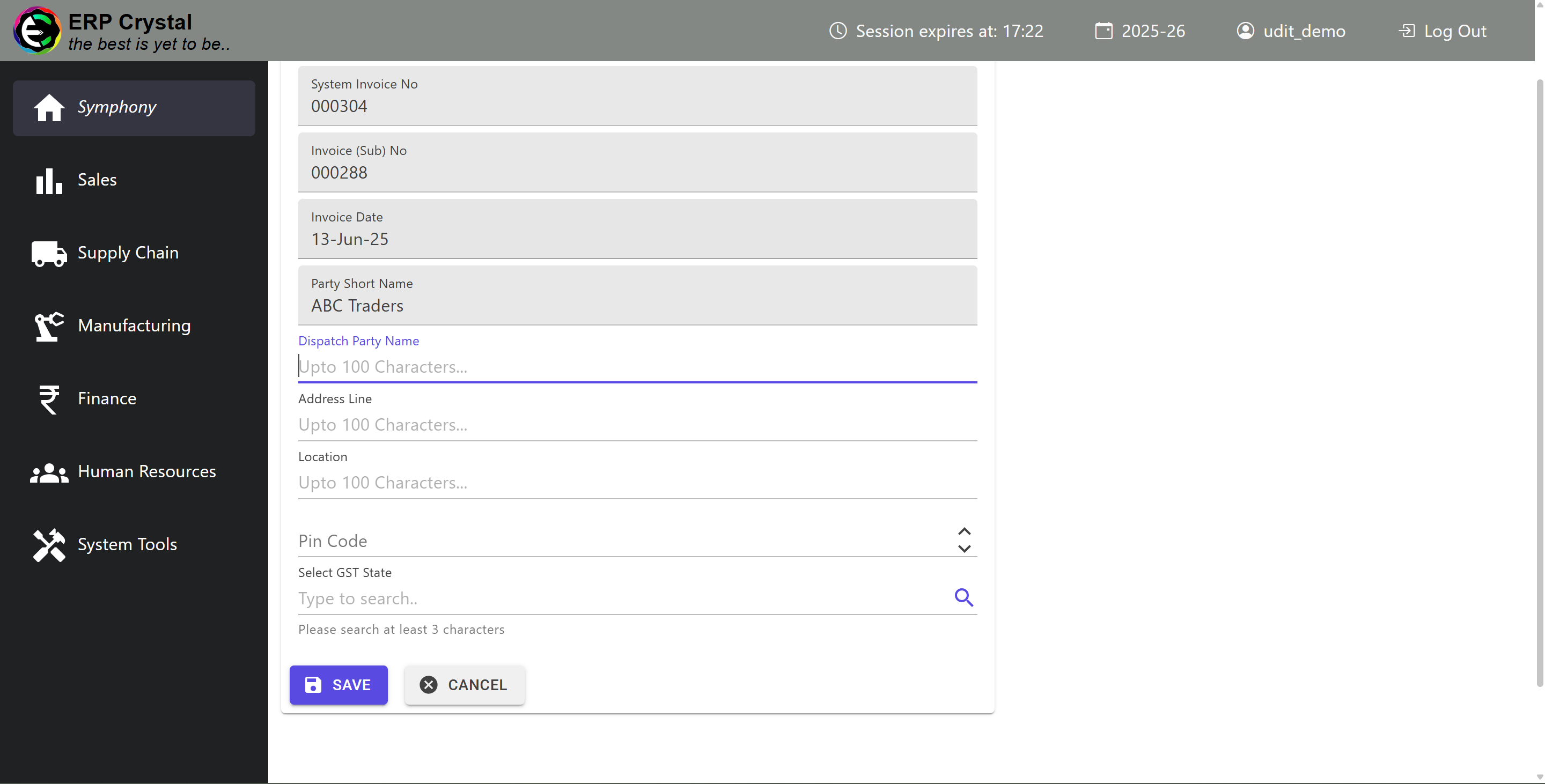

Update Dispatch Information (Optional)

Dispatch Details If you need to update Dispatch details:

- Go to Menu → Sales → Sales Invoice Details → Other Operations

- Click “Update Dispatch Info”

- Fill in all required dispatch details

>

How to Generate E-Invoice & E-Way Bill

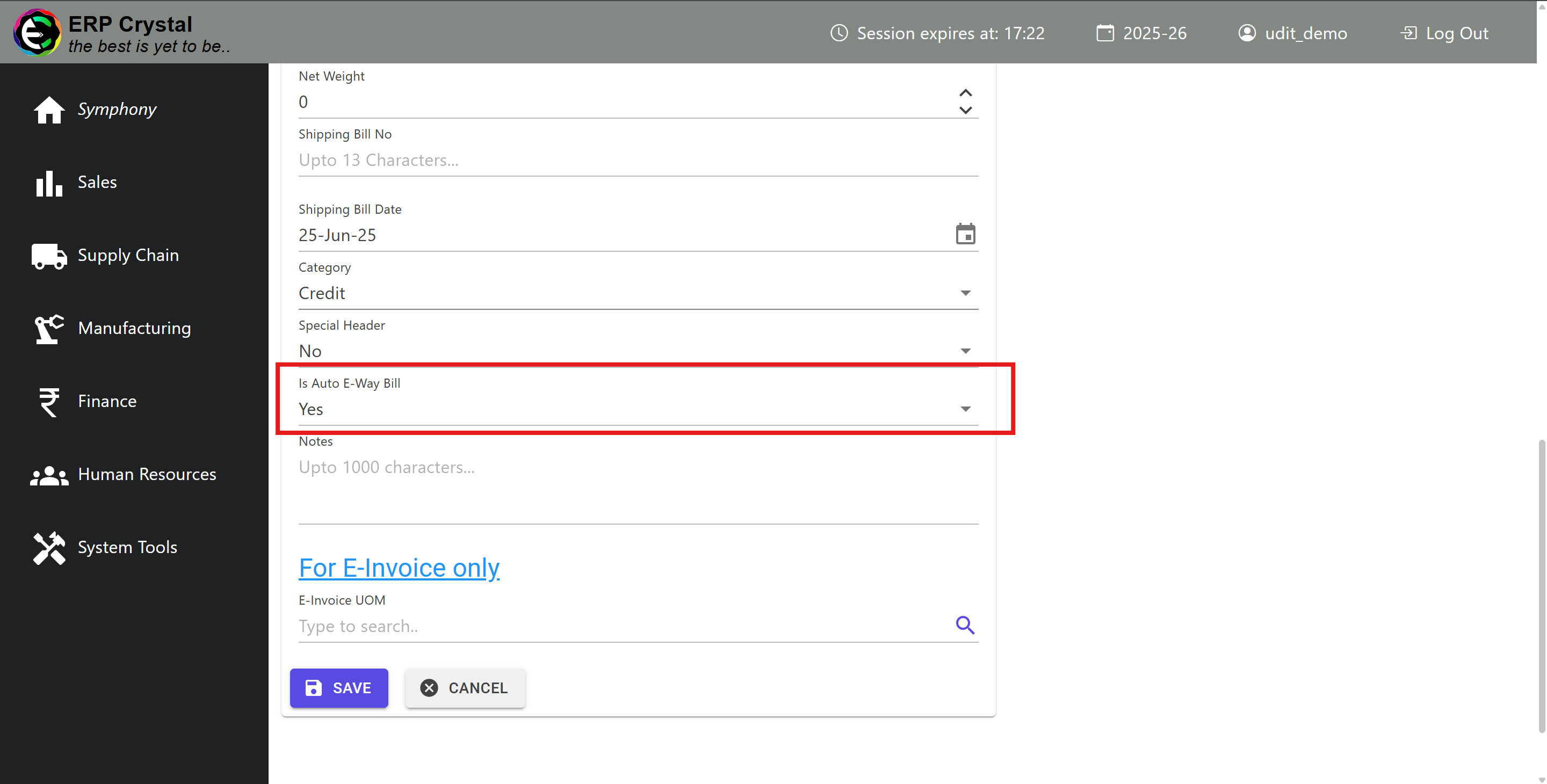

Step 1: Enable Auto E-Way Bill (Optional)

💡 Pro Tip

If you want both e-Invoice AND e-Way Bill generated together:When creating your invoice, set “Is Auto E-Way Bill” to Yes

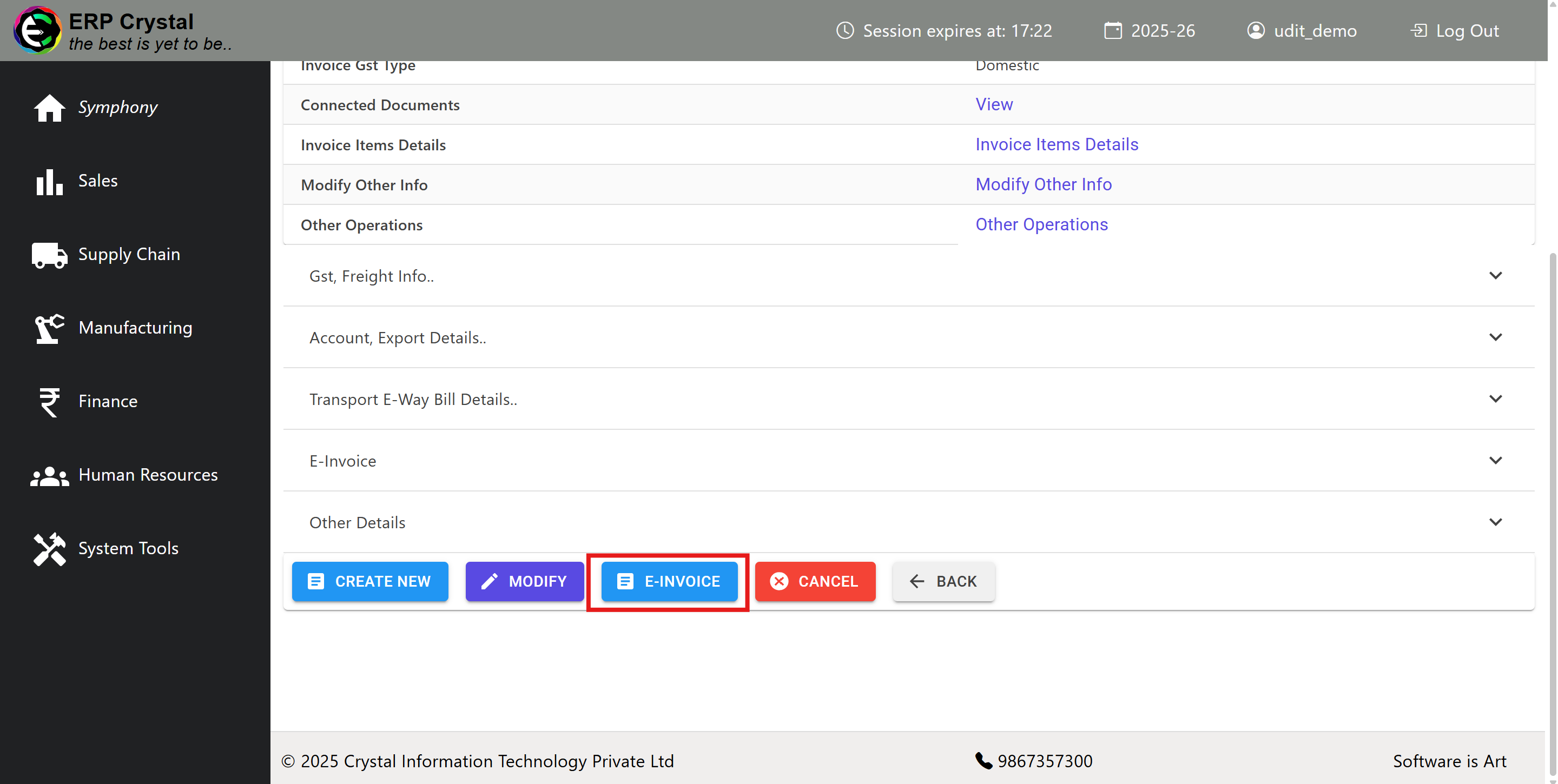

Step 2: Generate E-Invoice

Simple Process

- Go to Menu → Sales → Sales Invoice Details

- Click on E-Invoice tab

- Click “Generate E-Invoice” button

🎉 That’s it! Your e-Invoice (and e-Way Bill if enabled) are now generated and ready.

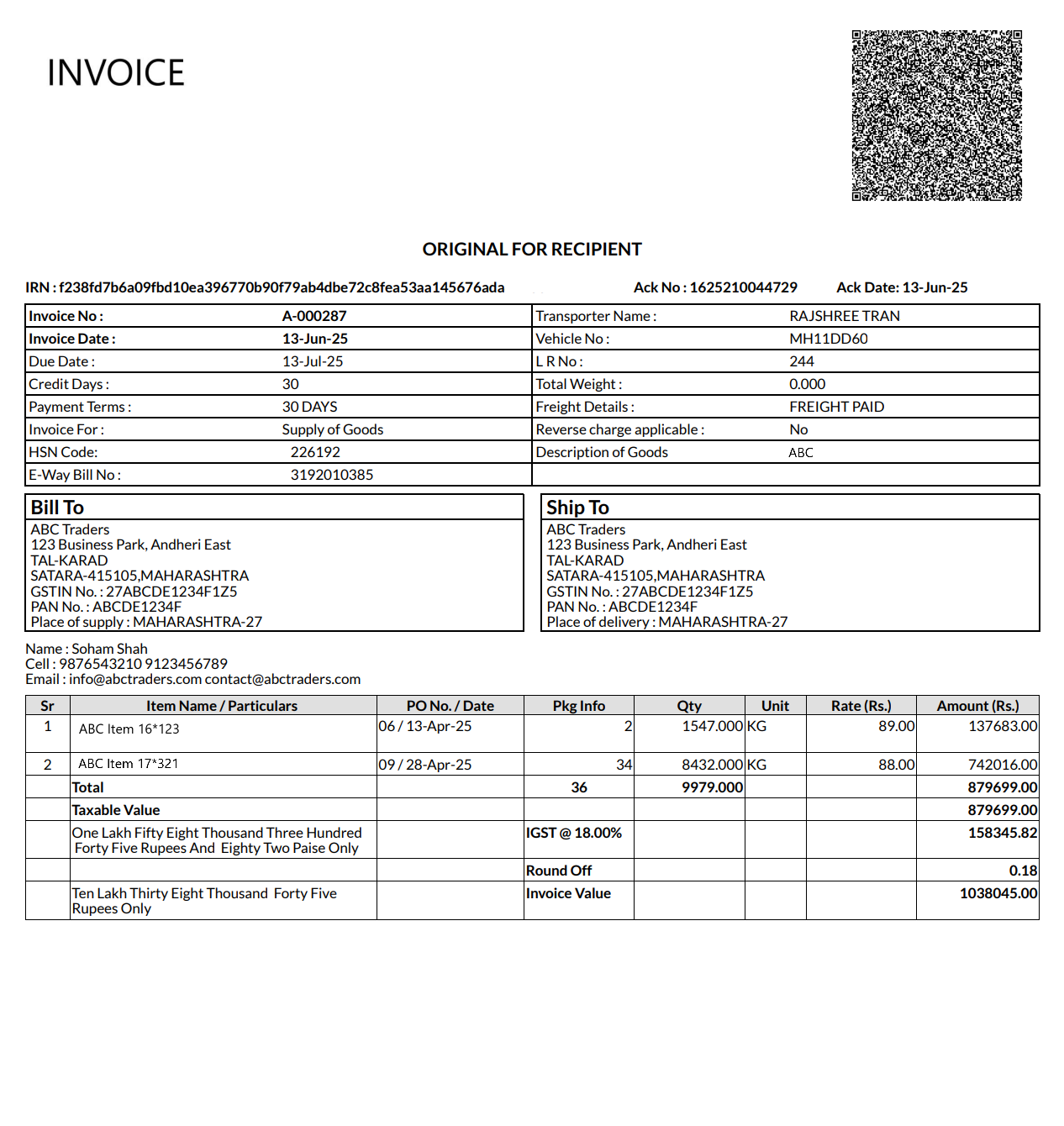

How to Print Your Documents

Print Invoice with QR Code

GST-Compliant Invoice

- Go to Menu → Sales → Sales Invoice Details → Other Operations

- Select “Print Invoice”

This gives you a GST-compliant invoice with IRN, QR code, and tax details.

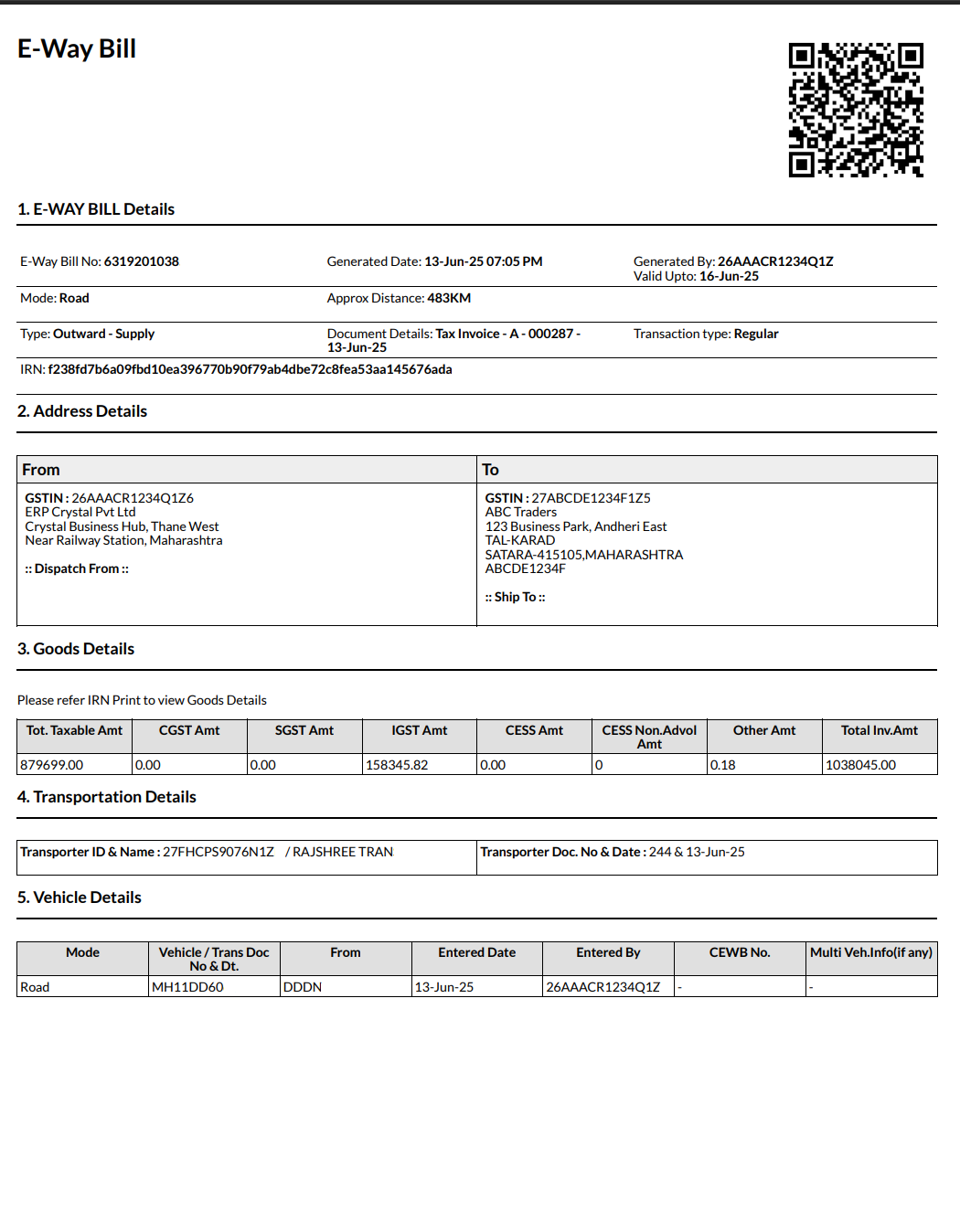

Print E-Way Bill

Transport Document

- From the same Other Operations menu

- Select “Print E-Way Bill”

✅Note: The “Print E-Way Bill” option appears only if “Is Auto E-Way Bill” is set to Yes, as described in Step 1.

Benefits Summary

🎯 One-Click Generation - Both documents created instantly

✅ Auto-Compliance - Validated against GSTIN

🖨️ Ready to Print - No manual uploads needed

🛡️ Error Prevention - Built-in validation checks

⏰ Time Saving - No more manual e-invoice portal work